[vc_row][vc_column][vc_column_text]

Meeting the deadlines for national and district tax obligations frees companies from penalties. Discover the dates in the 2021 tax calendar.

Having a clear process for the preparation, validation and approval of tax obligations allows for risk reduction and better use and value creation of tax information.

Decree 1680 of December 17, 2020, establishes the dates for filing and payment of the different tax obligations.

Among others, we can highlight the following obligations and the due dates according to the DIAN.

The declaration and payment of income tax and complementary tax for the taxable year 2020 for legal entities.

The income tax return and payment of income tax and complementary tax for the taxable year 2020 for individuals.

Individuals required to file income tax returns in 2021

1. Resident individuals are exempted from filing a VAT return if during the 2020 taxable year they were not liable for VAT and if, in addition, they comply with all of the following 5 requirements:

UVT Requirement (equivalent to $35,607) Value

- Gross net worth as of December 31 does not exceed 4,500 UVT : $160,232,000

- Gross income at December 31 less than 1,400 UVT: $49,850,000

- Credit card consumption does not exceed 1,400 UVT: $49.850.000

- Total purchases and consumptions for the year not exceeding 1,400 UVT: $49,850,000

- Consignments, deposits or investments not exceeding 1,400 UVT: $49.850.000

If you meet any of the above conditions, you must file an individual income tax return.

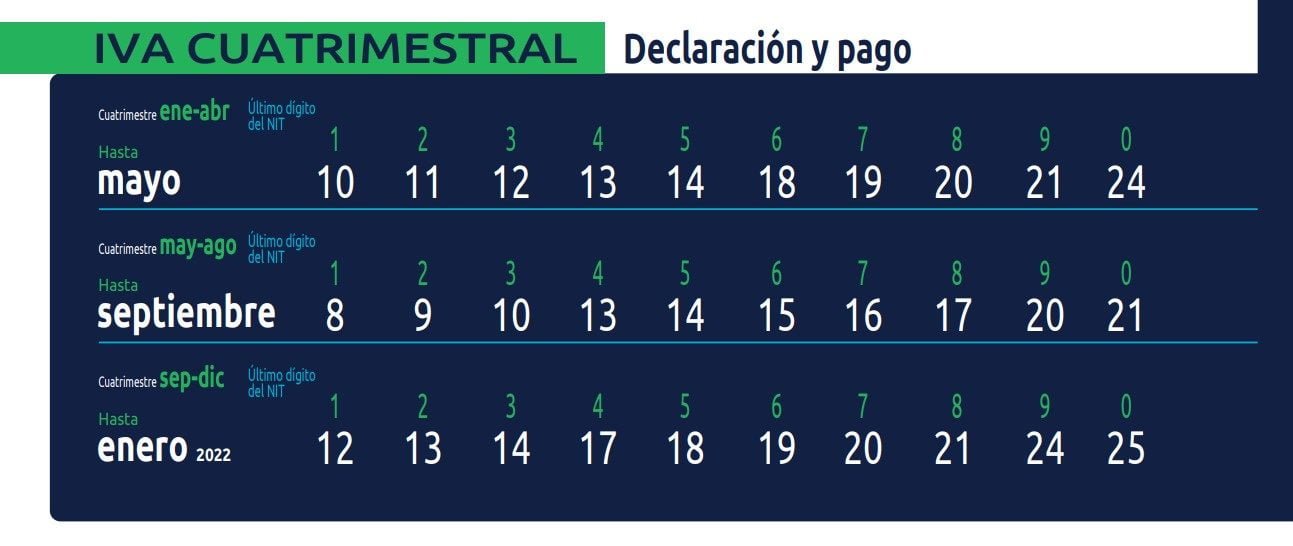

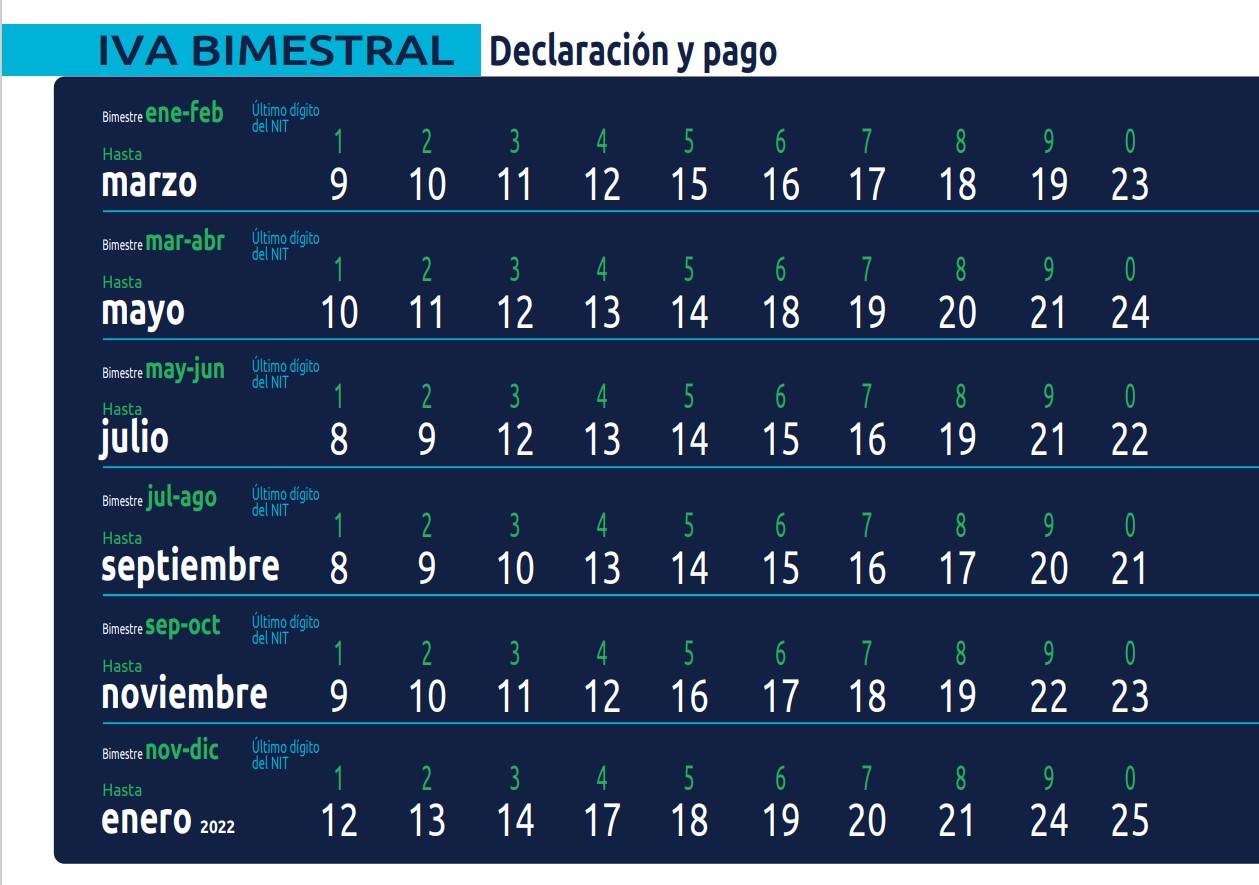

Sales tax declaration and payment

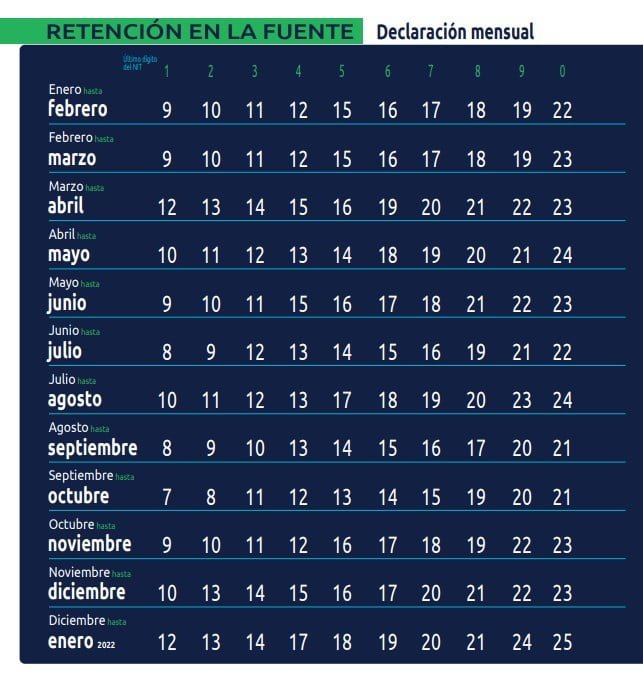

Monthly withholding tax return and payment at source

Bogota District Taxes

ICA Rete ICA

ICA Bogotá

Annual ICA Bogota

.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[button title=”See the 2020 tax calendar” link=”https://obcpartners.com/presente-la-declaracion-de-renta-2019/” target=”_blank” align=”” icon=”” icon_position=”” color=”” font_color=”” size=”2″ full_width=”” class=”” download=”” rel=””][/vc_column_text][/vc_column][/vc_row]